Real Estate vs. Stock Market in 2025: Where Should You Invest? 🏡📈

In the world of investing, two giants dominate the conversation — real estate and the stock market. Both have their passionate supporters and historical data to back their performance. But in 2025, with rapid economic shifts, AI innovations, and global uncertainty, which one should you choose? 🤔

Let’s break down the pros, cons, and key differences between real estate and stock market investing so you can decide what works best for your financial goals.

1. Understanding the Basics 🔍

Real Estate Investing 🏠

Real estate involves purchasing physical properties like houses, apartments, commercial spaces, or land with the goal of earning income or appreciation. You can invest by:

- Buying rental properties

- Flipping homes

- Investing in Real Estate Investment Trusts (REITs)

Stock Market Investing 📊

The stock market allows you to buy shares of publicly traded companies. As a shareholder, you own a piece of the company and can earn:

- Dividends (a share of profits)

- Capital gains (when the stock price rises)

You can invest via:

- Individual stocks

- ETFs (Exchange Traded Funds)

- Mutual funds

2. Entry Barrier & Accessibility 🚪

Real Estate: High Entry Cost 💰

Buying property typically requires:

- Large down payments (10%-20%)

- Mortgage approval

- Ongoing maintenance

Even with REITs, you need to understand the real estate market and regulations.

Stock Market: Low Barrier, High Flexibility 🧩

You can start investing in stocks with as little as ₹100 or $10 using apps like Zerodha, Robinhood, or Groww. It’s ideal for beginners, especially with fractional shares now widely available.

Winner: Stock market for accessibility and ease of entry.

3. Liquidity Matters 💧

Real Estate: Low Liquidity ⌛

Selling property takes time — weeks or even months. It’s not ideal if you need cash quickly.

Stock Market: High Liquidity ⚡

Stocks can be bought and sold within seconds during trading hours. Need emergency funds? You can liquidate your holdings almost instantly.

Winner: Stock market for liquidity.

4. Risk and Volatility 🎢

Real Estate: Stable But Market-Dependent 🏗️

Property prices generally rise over time but can be affected by:

- Interest rates

- Location demand

- Legal issues

Stock Market: High Volatility, High Reward 🚀

Stocks can fluctuate wildly due to:

- Company performance

- Economic data

- Global events

But historically, long-term stock investors have seen significant returns.

Winner: Real estate for stability, stocks for long-term high returns.

5. Passive Income Potential 💸

Real Estate: Rental Income Stream 🏢

Real estate can provide consistent rental income, which can even rise with inflation. However, it comes with tenant management and upkeep.

Stock Market: Dividends and Growth 📈

Many companies pay dividends quarterly, and if reinvested, they can compound over time. Plus, growth stocks can offer capital appreciation.

Winner: Tie – both offer passive income, but through different methods.

6. Tax Implications ⚖️

Real Estate

- Mortgage interest and depreciation may be tax-deductible.

- Capital gains tax on property sales can be high unless reinvested under certain sections (like 54F in India).

Stock Market

- Short-term capital gains (under 1 year) are taxed higher.

- Long-term capital gains usually have lower tax rates.

- Dividends may also be taxable depending on the country.

Winner: Depends on the country, but stocks usually have simpler tax rules.

7. Inflation Hedge 🛡️

Real Estate: Excellent Inflation Hedge 🏘️

As prices rise, so do rents and property values. Real estate is often considered one of the best ways to protect against inflation.

Stock Market: Mixed Results 📉📈

Stocks can beat inflation long-term, but short-term market dips during inflationary periods can be severe.

Winner: Real estate for inflation protection.

8. Management & Time Commitment ⏳

Real Estate: Active Involvement Needed 🛠️

Property management can be time-consuming, especially with repairs, tenants, and paperwork — unless you hire a property manager (which cuts into your profits).

Stock Market: Hands-Off Investing Allowed 🧘

You can invest in index funds or ETFs and leave it alone. Robo-advisors can also manage your portfolio automatically.

Winner: Stock market for time efficiency.

9. Historical Returns Comparison 📊

Note: Returns vary depending on region, market cycle, and investor decisions.

10. Which One is Better for YOU? 🤷

Here’s a quick decision guide:

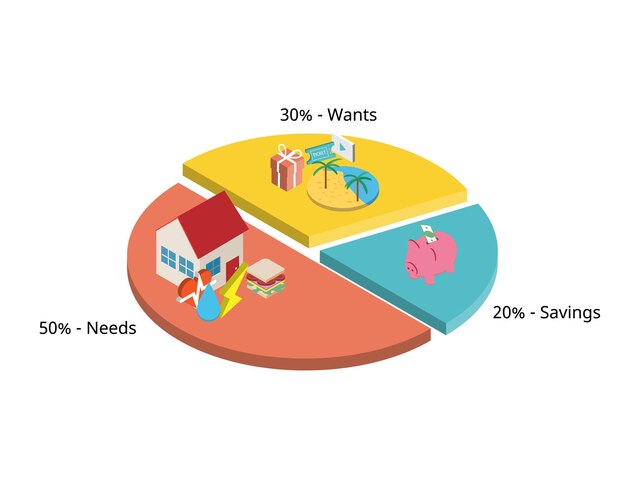

The Best Strategy? Diversification! 🌐

Why choose one when you can invest in both?

- Use stocks for liquidity, growth, and diversification.

- Use real estate for stability, rental income, and inflation protection.

Many successful investors use a 50/50 or 60/40 portfolio — balancing both assets to reduce risk and maximize returns.

Final Thoughts 💭

In 2025, both real estate and stock market investing remain solid wealth-building paths. The best choice depends on your goals, risk appetite, capital, and lifestyle.

If you’re new, start with stocks for their accessibility. If you’re ready for a long-term commitment with higher capital, explore real estate. Either way, the key is to start investing early, stay informed, and think long term.