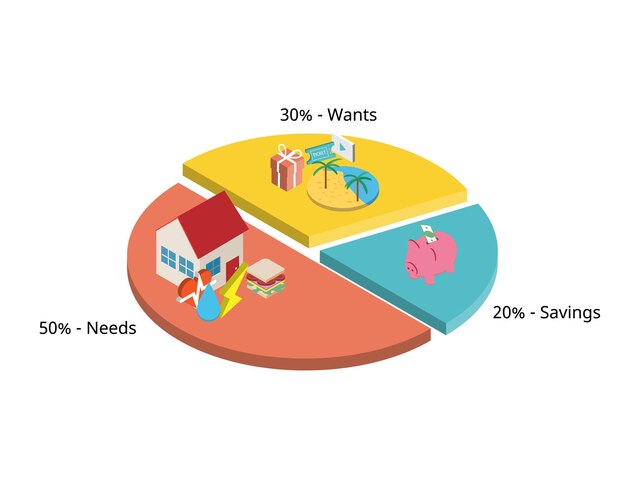

The 50/30/20 Budget Rule: The Simple Formula for Financial Success 💰📊

Introduction

Are you struggling to manage your finances? 😟 Do you often wonder where all your money goes by the end of the month? The 50/30/20 Budget Rule is a simple yet effective way to take control of your finances and ensure you’re saving while still enjoying life.

This budgeting method, popularized by Senator Elizabeth Warren, divides your income into three main categories:

- 50% for Needs 🏠

- 30% for Wants 🎉

- 20% for Savings & Debt Repayment 💰

In this blog, we’ll break down the 50/30/20 rule, explain its benefits, and show you how to apply it effectively. Let’s dive in! 🚀

What is the 50/30/20 Budget Rule? 🤔

The 50/30/20 rule is a simple budgeting framework designed to help individuals manage their income efficiently. It ensures a balanced approach to spending and saving, making it easier to achieve financial stability.

Here’s how it works:

🔹 50% – Needs: Essential expenses that you must pay to live comfortably.

🔹 30% – Wants: Lifestyle choices and things that bring joy.

🔹 20% – Savings & Debt Repayment: Future financial security and freedom.

Now, let’s break down each category in detail. 📌

50%: Needs – The Essentials You Can’t Ignore 🏠

Half of your after-tax income should go towards essentials—things you absolutely need to survive and maintain a basic standard of living.

Examples of Needs:

✅ Rent or mortgage payments 🏡

✅ Utilities (electricity, water, gas, internet) 💡

✅ Groceries 🍎

✅ Transportation (fuel, public transit, car payments) 🚗

✅ Health insurance & medical expenses 🏥

✅ Minimum loan & debt payments 💳

How to Stay Within 50%?

💡 Tip: If your needs exceed 50% of your income, look for ways to cut costs, such as moving to a more affordable home, using public transport, or reducing unnecessary bills.

30%: Wants – Enjoying Life Without Overspending 🎉

This portion is for the non-essential expenses—things that enhance your lifestyle but aren’t necessary for survival.

Examples of Wants:

🎬 Entertainment (Netflix, movies, concerts)

🛍️ Shopping (clothing, gadgets, luxury items)

🍽️ Dining out and takeout food

✈️ Travel and vacations

📱 Premium subscriptions (Spotify, YouTube Premium, gym memberships)

How to Stay Within 30%?

💡 Tip: Prioritize what truly makes you happy. Instead of impulse spending, plan your discretionary expenses and track them.

20%: Savings & Debt Repayment – Building Financial Security 💰

The final 20% should be dedicated to your financial future—saving for emergencies, investing, and paying off debt faster.

Where Should This 20% Go?

💰 Emergency Fund – 3-6 months of expenses for unforeseen events.

📈 Investments – Stocks, mutual funds, real estate, or retirement accounts (401k, IRA).

💳 Debt Repayment – Extra payments on high-interest loans to become debt-free faster.

📊 Retirement Savings – The sooner you start, the more your money grows over time!

How to Stay on Track?

💡 Tip: Automate savings by setting up an automatic transfer to your savings or investment account each month.

How to Apply the 50/30/20 Rule to Your Income? 📊

Let’s say your after-tax income is $5,000 per month. Here’s how you’d allocate it:

💸 50% Needs: $2,500 for rent, groceries, utilities, etc.

🎉 30% Wants: $1,500 for entertainment, shopping, dining out.

💰 20% Savings & Debt: $1,000 for savings, investments, and debt payments.

What If Your Income is Irregular?

If your income fluctuates (freelancers, business owners), base your budget on an average monthly income and adjust accordingly.

Benefits of the 50/30/20 Budget Rule 🌟

✅ Simple & Easy to Follow – No complicated calculations.

✅ Balances Spending & Saving – Helps you enjoy life while preparing for the future.

✅ Prevents Overspending – Gives a clear structure to financial decisions.

✅ Reduces Stress – Knowing where your money goes eliminates financial anxiety.

✅ Encourages Healthy Money Habits – Helps you build wealth over time.

Common Mistakes to Avoid 🚨

❌ Ignoring Budget Adjustments – If your expenses change, update your budget!

❌ Mixing Needs & Wants – Be honest about what’s truly essential.

❌ Not Prioritizing Debt Repayment – High-interest debt should be tackled first.

❌ Neglecting Emergency Savings – Don’t rely on credit cards for emergencies.

Final Thoughts: Take Charge of Your Money Today! 🚀

The 50/30/20 budget rule is a powerful tool for taking control of your finances. It ensures that you can cover essentials, enjoy your hard-earned money, and build wealth for the future.

👉 Start today! Track your expenses, categorize them, and make adjustments to align with this rule. Your future self will thank you! 🙌

📢 What’s your biggest budgeting challenge? Drop a comment below! ⬇️